TradingView alerts automation

With OctoBot cloud, you can easily turn any TradingView price alert, indicator or pinescript strategy into trades. Trading can be on your favourite exchanges or risk free with simulated funds.

To trade on any TradingView alert, you first need to configure the alert webhook for your traded pair if not done already.

If you are not sure about how to use TradingView alerts, have a look at our TradingView trading tutorial.

Trading on price alerts

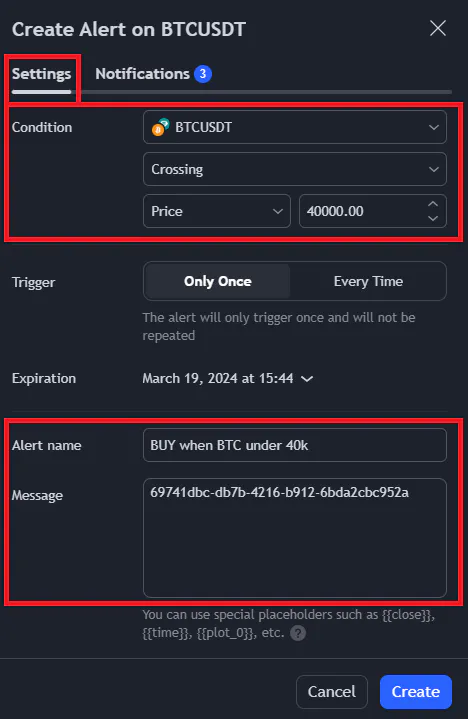

TradingView can automatically send an alert when the price of an asset crosses a given value.

This price alert that will notify my automation of a buy order identified by d4f18425-b3b6-4e6b-94d0-61f362aa10c7 if BTC crosses 40.000 USDT.

Trading on indicators

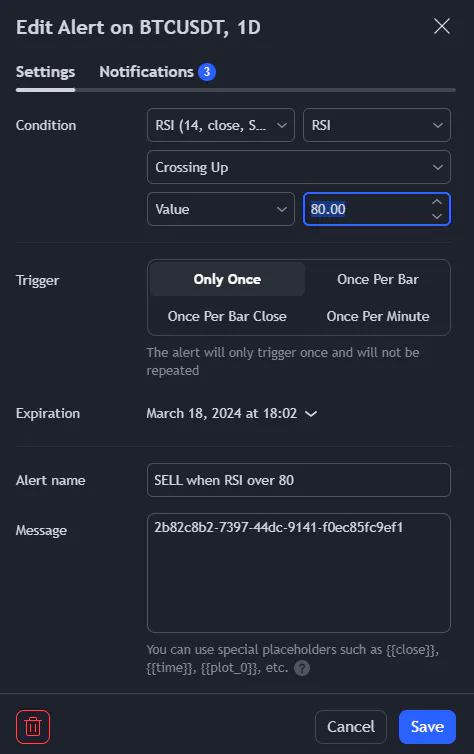

TradingView can automatically send an alert when something happens on a indicator.

This indicator alert using the Relative Strength Index (or RSI) that will notify my automation of a sell order identified by 2b82c8b2-7397-44dc-9141-f0ec85fc9ef1 if the RSI value crosses 80, which I consider as a sell signal.

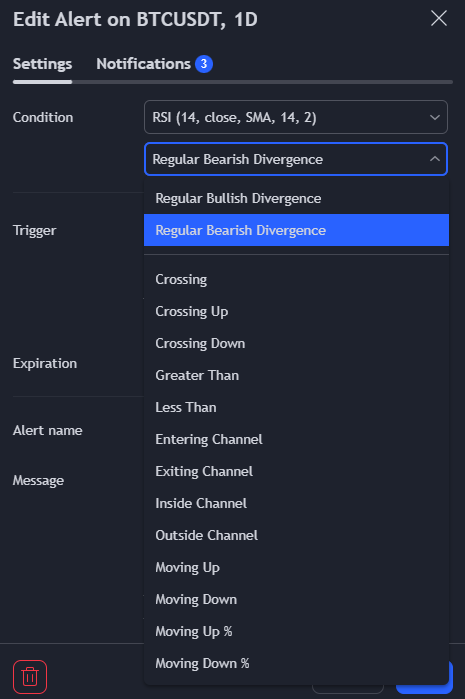

An indicator alert can be a simple event such as crossing an indicator value or a much more advanced condition such as Bearish Divergences or channel exiting as shown in the RSI indicator example above.

Any TradingView indicator (built-in or custom, paid and free) can be used to send alerts and automate your trades using your TradingView OctoBot automations.

Trading on Pine Script strategies

For advanced TradingView users.

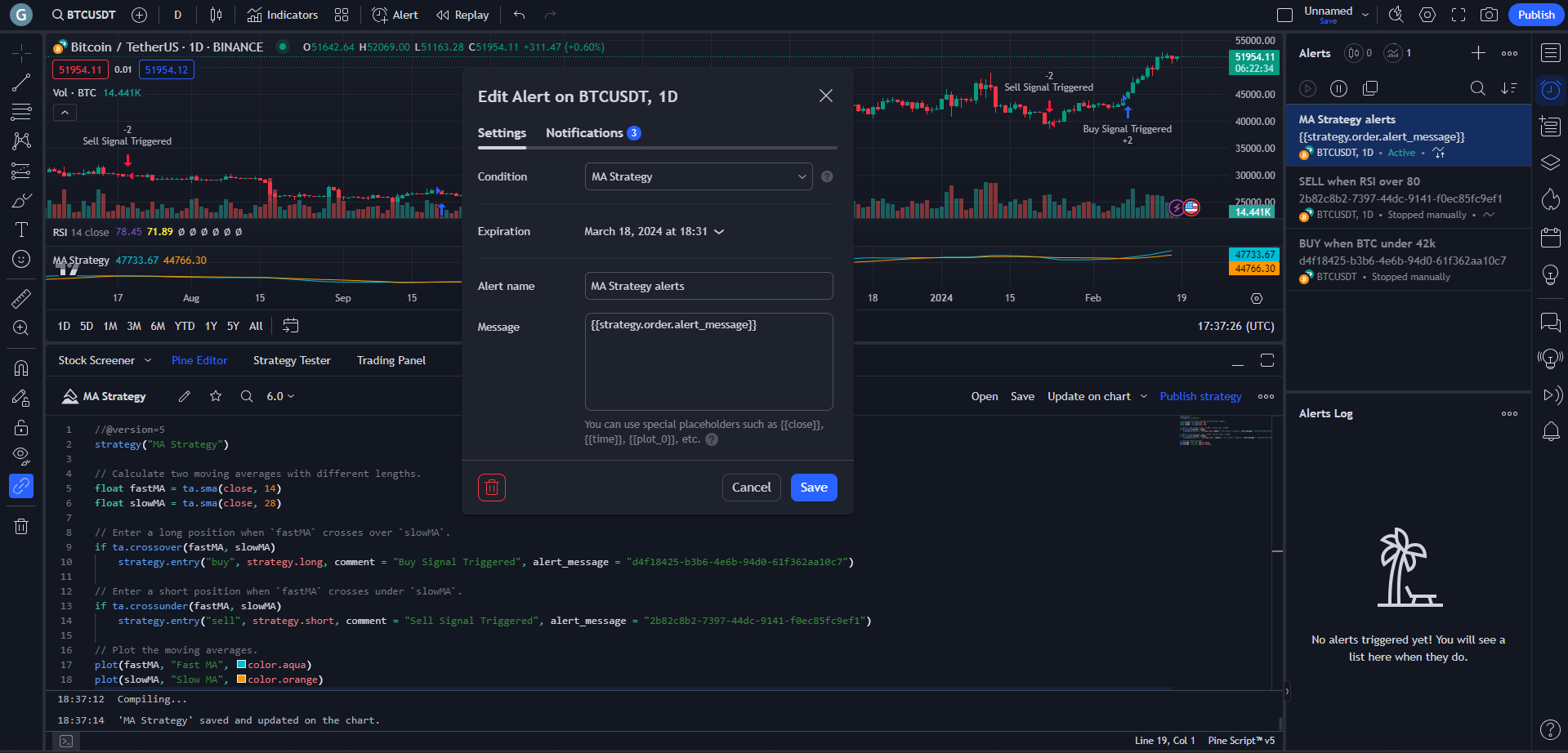

TradingView can automatically send an alert when your Pine Script strategies create orders.

To send alerts from a Pine Script strategy, use the alert_message parameter from Pine Script strategy functions which can create orders.

To send alerts with your Pine Script strategy, create a new alert and make sure to:

- Select the name of your strategy as the condition

- Replace ALL the message content with exactly

{{strategy.order.alert_message}}

In the strategy’s Pine Script code, add alert_message = "yourAutomationIdentifier" to your strategy entry, exit or close calls.

Example with a d4f18425-b3b6-4e6b-94d0-61f362aa10c7 automation identifier:

strategy.entry("Buy", strategy.long, comment = "Buy Signal Triggered", alert_message = "d4f18425-b3b6-4e6b-94d0-61f362aa10c7")

Using TradingView Pine Script strategies to automate you trading can be a bit complicated but very powerful as you can also use the TradingView integrated strategy tester to optimize your strategy.

Strategies examples

- Death and Golden Cross Strategy: buy and sell based on Death and Golden Crosses.

Alerts security

The OctoBot cloud infrastructure is designed with the security in mind. It is the same when it comes to the TradingView alerts integration.

Triggering your automations

- Only alerts originating from the offical TradingView website can trigger a TradingView automations.

Automation rate limit

In order to reduce the impact of misconfigured alerts and prevent exploits of the system, there is a limit to the number of times a given automation can be triggered over 60 minutes.

The amount of bots and automations you can have is unlimited but each individual automation can be triggered at most 20 times over 60 minutes. Please contact us if you need to increase this limit.